Introduction

Since the 2020 year began, Covid-19 has disrupted the B2B market in ways that no one anticipated. The pandemic turned demand patterns in many sectors upside down and rendered conventional market predictions inaccurate.

To remain relevant, B2B companies had to focus more on maintaining customer relationships than on selling. This meant employing different strategies that include:

- Helping customers meet their immediate needs through flexible product or service pricing and trainings

- Shifting marketing and sales process from the traditional face-to-face interactions to digital communication

- Empowering sales and marketing teams with appropriate tools to facilitate remote selling

- Reviewing priorities including sales, service agreements and liquidity in order to realize value

As market attention shifts from the pandemic to the recovery period in Q3 and Q4 of 2020, B2B companies that applied these strategies are likely to begin experiencing rewards even as new trends take root in the market.

Even so, emerging economic scenarios will vary from one country to another during the recovery period. To a large extent, these scenarios will be determined by factors such as stimulus packages offered by governments and the effects that Covid-19 has had on local economies.

Recovery speeds will also vary across countries. The reality is that B2B markets may not realize historical returns from existing customers and product mix fast. But one thing the Covid-19 crisis has shown is that opportunities can emerge quickly. At the same time, thriving markets can slow down pretty fast. This means in Q3 and Q4 of 2020, B2B companies have to be more agile in crafting growth strategies.

While it is not clear how long businesses will have to operate in the new normal, several changes will happen in the B2B market. New trends are beginning to emerge in the last two quarters of 2020.

In this article, we look at five predictions for these quarters and how these trends will shape the B2B market outlook as the year comes to an end.

B2B Market Outlook in Q3 and Q4

1. B2B Buyers Will Be Willing to Pay for Solutions

According to a study by Mckinsey & Company, there is a shift in the shopping behavior of at least 60% of B2B consumers. Most of them are now focused on value and convenience. The reality is that following the Covid-19 pandemic, B2B buyers will have new needs and will be looking for innovative offerings to address those needs.

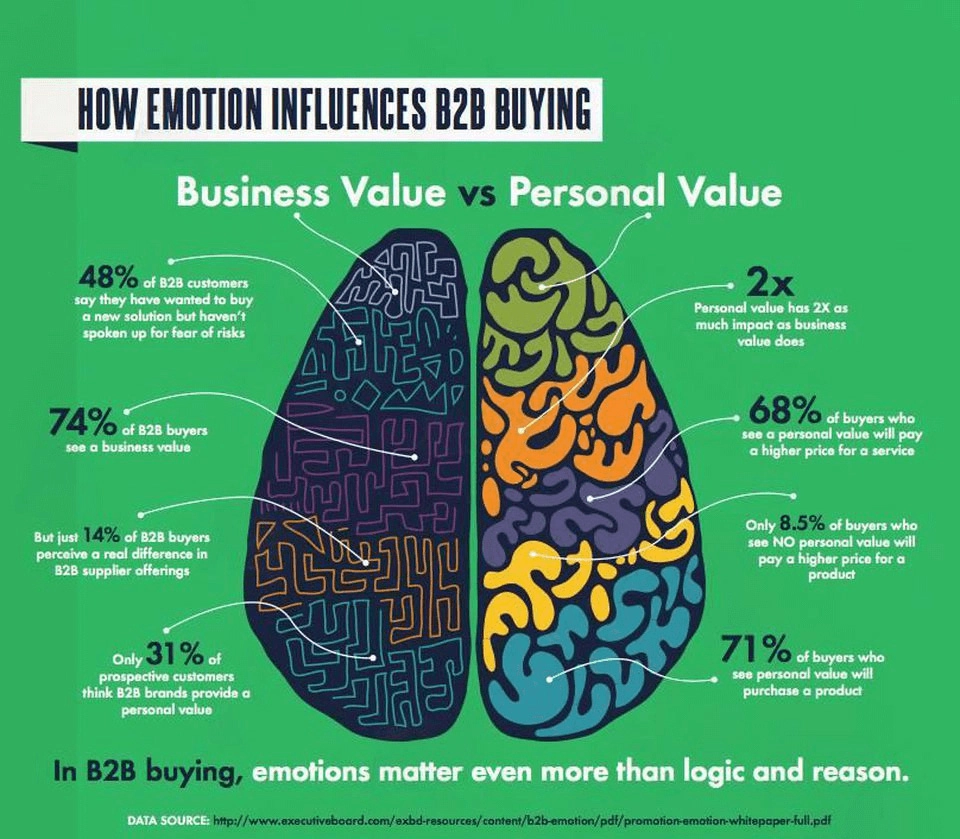

The most successful companies in the last two quarters of 2020 will be those that identify these needs and offer effective solutions. Considering that 74% of B2B buyers consider business value before making a purchase, they will be willing to pay for offerings that offer solutions that can help them grow their enterprises to the next level.

To meet this need, B2B sellers will have to accelerate the process of developing, prototyping, iterating and marketing their innovations to B2B buyers.

For sellers, this will mean building the internal agility their functions need to handle the dynamic customer situations. It also means examining their innovations rapidly while setting priorities for new experiences that align with digital and remote working trends.

2. B2B Purchasing will Begin to Increase in September

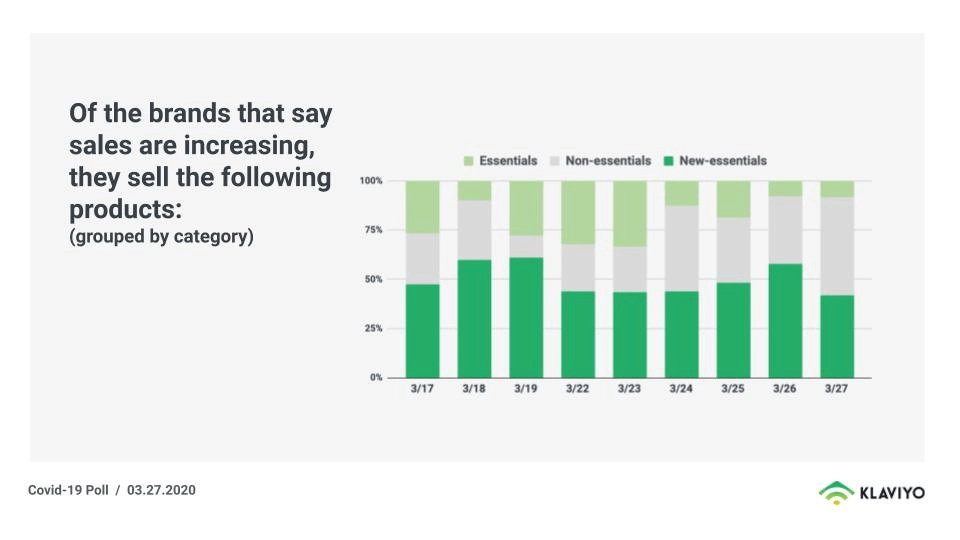

Covid-19 has caused a shift in B2B buying behavior and preferences – and even changed sales for many companies. But this does not apply to all industries. After months of slowed B2B sales, the tide is set to start changing this September. B2B buyers are expected to increase purchases for new-essentials.

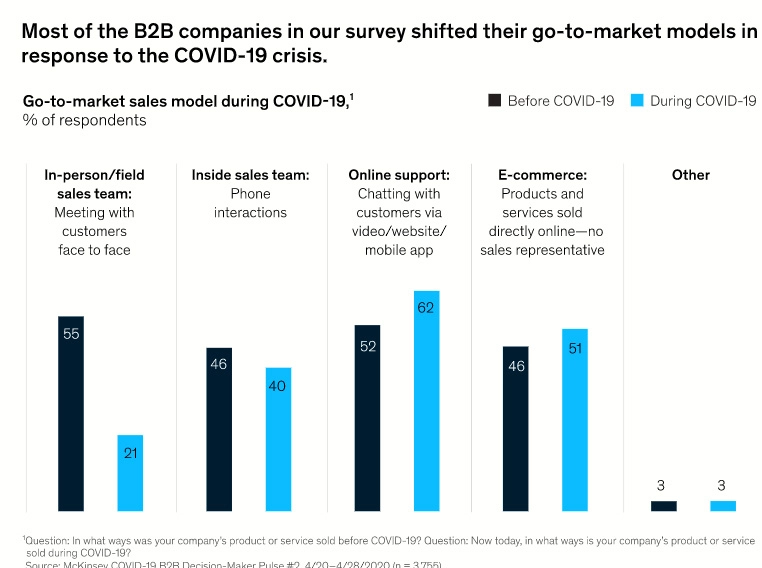

One niche that will experience a boom as the B2B market recovers is the customer service and marketing niche. Covid-19 has changed the way B2B buyers interact with sellers with a survey by McKinsey & Company showing a 34% drop in in-person selling and a 10% rise in online support during the pandemic.

Moving on to Q3 and Q4, B2B buyers will maintain remote interactions with customers. This means sales reps and self-service portals will remain dominant aspects of B2B marketing models – whether a company is selling to large enterprises or small business enterprises.

3. The B2B Market Will Start Responding

Over the last six months, Covid-19 has affected B2B buyer behavior significantly. Most B2B buyers cut down on their spending as a way of mitigating losses, preventing layoffs and averting business closure.

In most instances, purchases were limited to essential products or services such as software to enable staff to continue working from home. As economies across the globe reopen in Q3 and Q4, B2B buyers will start responding to efforts that companies made to respond to their needs. Such efforts included:

- Providing engaging resources to help customers resolve any product or service problems fast

- Educating customers so they can maximize the value of product or service offerings

- Personalizing customer interactions to build trust and loyalty

- Extending free trial periods to give prospects prolonged experience with service offerings

- Listening to customer feedback and rediscovering their changing needs

These efforts did not yield much revenue during the pandemic. However, as the B2B market recovers from the pandemic, these strategies will begin to prove beneficial companies that employed them during the pandemic.

4. Customer Experience Will Become the New Focus

The unexpected impact of Covid-19 on B2B sales has made companies realize the importance of retaining existing customers as opposed to recruiting new ones. In quarter 3 and 4 of 2020, B2B companies will focus on giving pleasant experiences to their existing customer base in order to retain them and build loyalty.

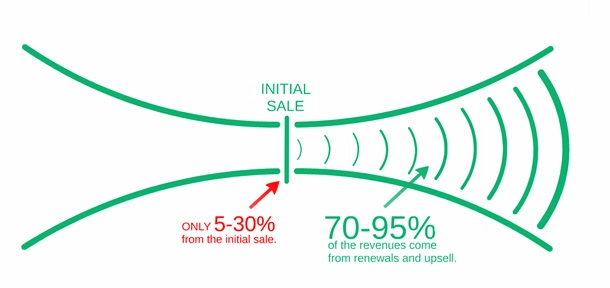

This approach is particularly important for SaaS firms and other service-based B2B companies considering that up to 95% of their revenues come from upselling current customers and renewals.

As the B2B market re-emerges from the Covid-19 crisis, B2B companies will focus less on spending huge amounts on mass marketing activities to attract new customers.

Instead, they will work hard to delight their current customer base by giving them pleasant experiences any time they interact with them. Some of the customer delight strategies that will come to play in the next two quarters include:

- Resolving customer issues fast through self service portals

- Offering real-time customer service through live chats, auto-responses etc

- Being flexible with cancellation and refund policies

- Delivering relevant and personalized marketing campaigns to customers

- Giving customers pleasant surprises with event invites and free service upgrades

5. Customer Purchase Intent Signal Will Rise Steadily

In Q1 and Q2 of 2020, buyer behavior was disrupted by the uncertainty that was created by Covid-19. With most B2B buyers experiencing a drop in their sales revenue, their focus shifted to deriving maximum value from existing products or services while limiting spending to essentials.

But, as the world settles into the new normal and economies across the world begin to reopen, this trend is likely to change in the coming months. B2B buyers are learning to live with Covid-19. Their outlook towards the market is shifting – from pessimistic to being optimistic. As the B2B market begins to recover in Q3 and Q4 of 2020, the purchase intent for B2B buyers will rise steadily.

During this quarter, B2B purchase decisions will be driven by several factors:

A. Economic Conditions

During the Covid-19 recovery period, governments across the globe will be giving stimulus packages and incentives to businesses as a way of aiding their recovery. These efforts will create conducive economic conditions for B2B buyers, which will in turn boost their purchase intent signals.

B. Business Objectives

As the B2B market emerges from the Covid-19 crisis, B2B buyers will only have one goal – to recover lost sales or market. This goal is expected to inform their spending in production and marketing their offerings. As they pursue their goals, it is expected that their purchase intent will continue to rise.

But these are not the only factors that will lead to increased purchase intent. Just like B2C buyers, a significant number of B2B buyers will be interested in buying from companies that adopt purposeful marketing.

According to a report by Ernst & Young, 62% of consumers are likely to buy from brands that they perceive to be good to society as the market emerges from the pandemic. A further 29% are willing to pay more to companies that contribute positively to the community while 42% are willing to buy from brands that produce goods locally.

Final Thoughts

In the first and second quarter of 2020, Covid-19 pandemic turned demand patterns in many sectors upside down and rendered conventional market predictions inaccurate. To deal with these unprecedented changes, B2B companies were forced to slow down on selling, reduce spending, focus more on retaining existing customers and adopt digital customer interactions.

As attention shifts from the pandemic to the recovery period in Q3 and Q4 of 2020, the market is expected to start looking up. B2B buyers are expected to spend more on innovations that respond to their emerging needs and customer purchase intent is expected to rise steadily in the coming months. Even as the market resumes, it is expected that new trends such as digital selling and a focus on customer experience will remain relevant in the last two quarters of 2020.

Our blog

Latest blog posts

Tool and strategies modern teams need to help their companies grow.

B2B companies must generate leads that are ready to buy their products in order to me...

In the absence of a constant flow of leads, sales teams can't meet their targets and ...

Podcasts and webinars are powerful tools that marketers can use to reach new audience...