Introduction

Marketing activities of all kinds need a lot of data and understanding of your customers, industry, and how your product fits with both of them. But guess what you need for data-driven B2B demand generation? Market research.

Market research for demand generation is essentially the first step of any strategy you plan to follow. Be it buyer personas, choosing platforms, planning content, and whatever else, you need reliable research for it. And, the customer is usually at the center of it. In fact, research by Deloitte and Touche found that customer-centric companies were 60% more profitable compared to companies that were not focused on the customer.

In this article, we’ll cover everything from types of market research to the 4-step process for it. To start with though, let’s get the basics of market research out of the way.

What Exactly is Market Research?

Market research is like peering through a crystal ball for business insights. It’s the key that unlocks a treasure trove of knowledge, helping businesses understand their market, engage customers, and drive growth with confidence. But most importantly, market research helps in decision-making at all stages of the demand generation funnel.

Here are a few more reasons to get behind market research in 2023:

- Pinpoint and captivate the perfect audience segments.

- Craft offerings that hit the sweet spot of customer desires.

- Gain the upper hand by unraveling rivals’ secret strengths.

- Smartly invest resources to achieve the biggest bang for your buck.

4 Categories of Market Research in Demand Generation

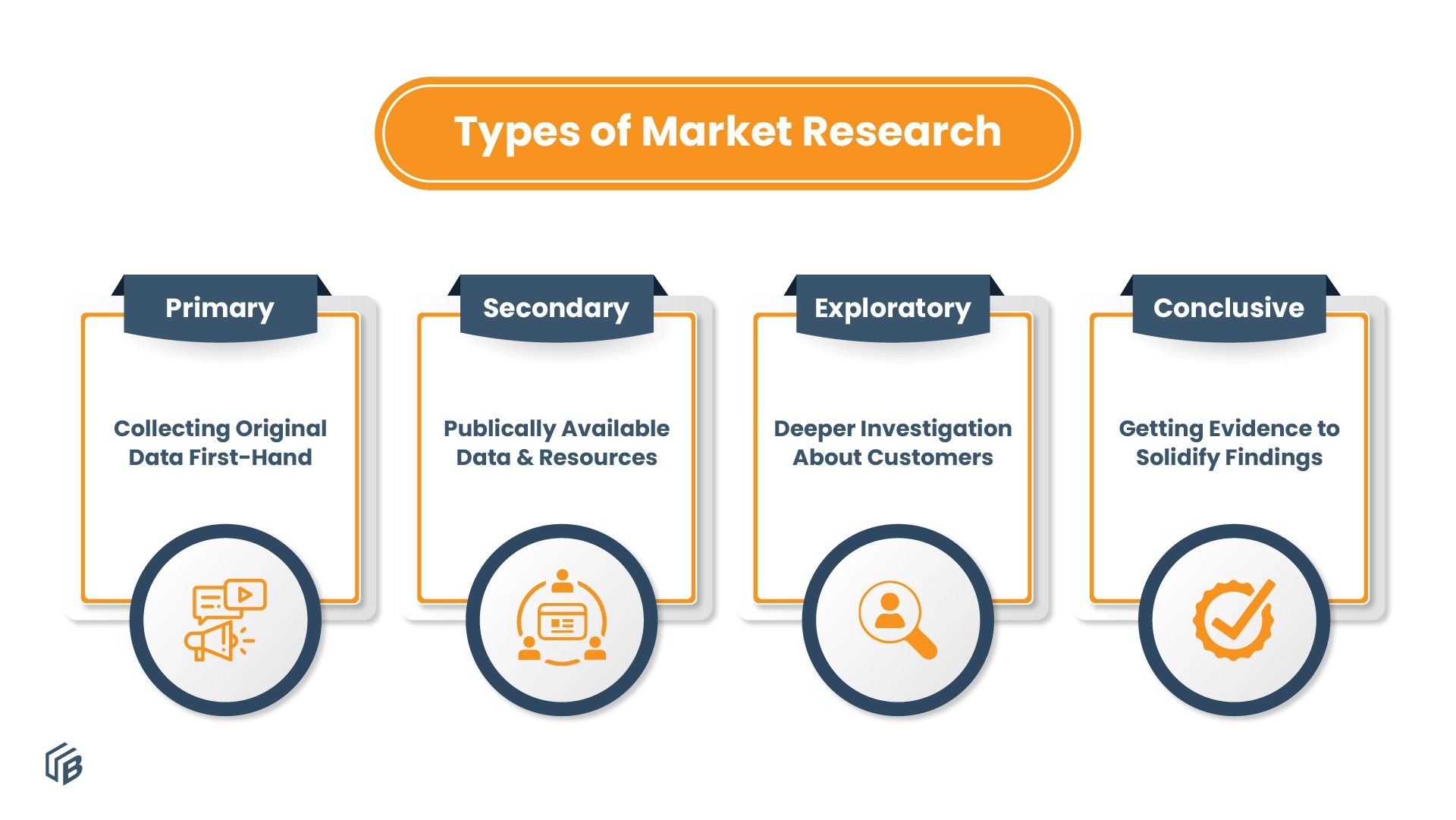

Market research can be applied at any stage of the buyer journey. And to get all of the benefits of a data-driven demand generation strategy, you’ll need to diversify your market research. The 4 main categories of market research include primary, secondary, exploratory, and conclusive

Primary Market Research – Collecting Original Data First-Hand

Primary market research is all about going directly to your target audience or market to collect fresh and original data. By engaging with customers and prospects firsthand, you gain valuable insights that can shape your business decisions and strategies. It includes sources like surveys, interviews, observations, or experiments that you conduct yourself.

Secondary Market Research – Publicly Available Data & Resources

Secondary market research involves tapping into a vast pool of existing data and knowledge. It involves digging through reports, studies, and data collected by others for different purposes. This treasure trove of insights helps you understand the broader market landscape, competitor analysis, and historical trends. Secondary market research also includes hiring a third-party provider for personalized data.

Exploratory Market Research – Deeper Investigation About Customers

Exploratory market research is all about delving into uncharted territory to gain a preliminary understanding of a problem or situation. Through methods like focus groups, interviews, and observations, you gather qualitative insights that unveil hidden nuances, uncover emerging b2b demand generation trends, and shed light on customer needs.

Conclusive Market Research – Getting Evidence to Solidify Findings

Conclusive market research is all about gathering concrete evidence and solidifying your findings. Through quantitative methods like surveys, experiments, and statistical analysis, you extract precise data that allows you to draw definitive conclusions. This rigorous approach helps you make informed decisions, validate hypotheses, and take strategic actions.

All 4 of these market research categories have near-equal importance. They help you stay on top of all demand generation trends and get the latest, most accurate insights about your target customers. But, let’s dive a little deeper with a few market research types.

10 Types of Market Research in Demand Generation

These 10 types of market research are like extensions of the 4 categories I explained earlier. Additionally, these types are not necessarily the exclusive representations of those categories. Instead, these types can be included in multiple categories with proper context. Let’s see what they are:

1. Interviews

Interviews are friendly conversations that uncover valuable insights, opinions, and experiences directly from individuals. These conversations provide a deeper understanding of customer perspectives and market dynamics. They also help you determine buyer personas for your demand generation strategies.

2. Focus Groups

Focus groups involve lively discussions among a small group of people, usually about your product. These discussions allow you to conduct product demo sessions, and get feedback or personal opinions, along with specific answers to some of your questions.

3. Product/Service Use

Product/service use research is about understanding the general need for the type of product you want to launch. It involves assessing the current market scenario and judging the success of other similar products. You could also analyze gaps in the market where your product can fit in.

4. Observation

Observation is exactly that! You observe your user’s experience through your website, campaigns, product use, navigation paths, heatmaps, etc. Observation is a key part of market research as you get direct, reliable data about user behavior.

5. Social Listening

Social listening involves monitoring social media platforms, forums, and review sites to gather valuable insights, identify trends, and uncover customer sentiments. This helps you make data-driven decisions and engage with your audience more effectively.

6. Experiments

Experiments involve manipulating variables in your product, campaigns, or any activities to observe how changes impact customer behavior and preferences. These changes help you make informed decisions, fine-tune strategies, and unlock insights that drive business growth.

7. Sales Data

Sales data research is analyzing past sales figures, trends, and patterns, you gain insights into customer preferences, demand fluctuations, and the performance of your products or services. It’s like having a not-so-secret map that guides you toward making informed decisions and maximizing your business’s success.

8. Competitive Analysis

Competitive analysis involves studying and evaluating your competitors’ strengths, weaknesses, strategies, and market positioning. By understanding their moves, you gain a competitive edge, allowing you to fine-tune your own marketing approach and stand out in the crowd.

9. Campaigns & Strategies

Researching campaigns and strategies involves identifying the best types of campaigns you need to use. Usually, this can be done by testing out different strategies and platforms to see which ones fit your audience and product perfectly. Combining this with competitive analysis also gives you a better idea.

10. Brand Awareness Research

Brand awareness research involves measuring the level of familiarity and recall people have with your brand name, logo, and key messaging. By understanding your brand’s awareness, you can gauge its impact and devise strategies to enhance recognition, leaving a lasting impression on your customers.

The 4-Step Process to Execute Market Research in Demand Generation

No matter which types or categories you choose in your market research, you’ll need to have a specific process in place. That’ll ensure proper execution and avoid pitfalls like inconsistencies and misleading data.

Understanding Your Ideal Buyer & Targeting Them

The first step of conducting market research starts with the audience/customers. To perform impactful market research, you need to have a comprehensive understanding of the end user. This knowledge will influence decisions that directly affect them. And since creating b2b buyer personas is essential for your demand generation strategy, you’d most likely make this step a priority.

Creating buyer personas is all about setting demographic and psychographic data and asking the right questions. That’ll tell you who exactly your ideal buyer is.

Preparing Data Points You Want to Determine

Data points or in simpler terms, your purpose behind the market research needs to be set before beginning. Apart from understanding the buyer, this is another precursor to starting the actual market research. Having data points gives you a focused vision to achieve accurate data without any unnecessary distractions.

Some data points can be qualitative like specific user behavior. And, some of them can be qualitative like the average duration your users spend surfing your website or other stats.

Conducting Research from Suitable Methods

Both of the previous steps allow you to zero down on specific methods of doing market research. By this point, you’ll also have an idea of how you need to execute your research effectively.

This step is about using the above-mentioned types of research in conjunction to get the desired data points from your ideal buyers.

Analyzing the Data Received from the Market Research

After the successful or unsuccessful execution of your market research, you’ll have a bucket-load of data to analyze. Now, regardless of the success of your campaigns or research, you’ll find numerous insights that will open up gaps. For first-timers, this is highly likely.

This final step of analyzing data is extremely important and dictates your future research plans and decision-making. Certain mistakes in your research can be identified at this stage, saving your demand generation strategy before it even begins.

Final Words

Now you know everything about market research in demand generation. What next?

Market research is just the start of a long and tedious process that is called demand generation. But, from the start of that process, you’ll find your data invaluable. Beginning with buyer personas and targeting to specific nurturing strategies, there is enough room to implement your research at all stages of the demand funnel.

Our blog

Latest blog posts

Tool and strategies modern teams need to help their companies grow.

B2B companies must generate leads that are ready to buy their products in order to me...

In the absence of a constant flow of leads, sales teams can't meet their targets and ...

Podcasts and webinars are powerful tools that marketers can use to reach new audience...